In this new era, impact investing isn’t a solo act anymore. It’s a fully integrated, collaborative ecosystem that blends technology, products, solutions, and capital. This isn’t just about startups surviving; it’s an accelerator for global sustainable development.

- Deep Collaboration in Tech & Products: Smart Use, Focused Innovation. For startups with limited funds, it’s smarter to focus those precious resources on solving specific pain points in niche markets rather than blindly jumping into a “tech arms race.” This means becoming a “smart user” of technology: leveraging readily available open-source tech, cloud services, and even cleverly combining different technologies from various startups. For example, using mature AI-as-a-Service (AIaaS) platforms can help build solutions quickly and at a lower cost, allowing resources to be poured into areas that create the most business value and market differentiation. At the same time, embracing the “lean startup” philosophy—rapidly testing the market with a Minimum Viable Product (MVP) and iterating quickly—ensures continuous innovation.

- Cross-Sector Collaboration for Solutions: Partnering to Expand Impact. Startups alone can’t tackle complex societal challenges. Building strong ecosystem partnerships effectively fills resource gaps and accelerates market expansion. This could mean actively becoming an “innovation arm” for larger companies, providing them with specific technologies or solutions and integrating into their ecosystem. Or, it could involve forming a “Taiwan A+ Team” or even seeking international alliances to jointly develop and promote innovative solutions for greater social and business impact.

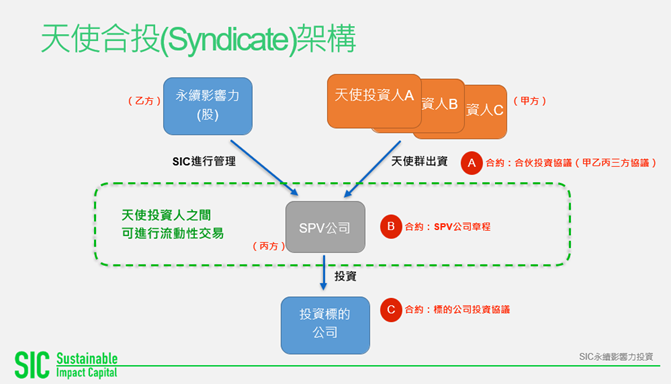

- Angel Syndicates – Collaborative Capital: A Game Changer. On the capital collaboration front, angel syndicate structures are becoming an effective way to connect smaller impact investors. This setup allows multiple angel investors to pool funds and invest in target startups through a Special Purpose Vehicle (SPV). Sustainable Impact Company (SIC) then manages the entire syndicate investment process to ensure performance goals are met. This is one of the most fundamental changes driving the impact investing ecosystem. Beyond traditional fundraising, the rise of various digital inclusive finance platforms is lowering investment barriers like never before, enabling “small-ticket impact investing” and allowing more people to participate in shaping the primary market.

Angel Syndicate Structure (Source: SIC)

Inclusive finance can effectively gather scattered small funds and direct them towards projects related to the UN Sustainable Development Goals (SDGs). This not only allows individual investors who were previously unable to participate to directly support the sustainable goals they believe in and earn appropriate returns, but it also opens up more diverse and resilient funding sources for startups, creating a positive cycle. At the same time, it flips the long-held corporate view of ESG (Environmental, Social, and Governance) as merely a cost or compliance requirement. Instead, it transforms ESG into a crucial asset for boosting employee loyalty, strengthening corporate branding, and even retaining talent sustainably. The vision is to bring long-term and stable social and human capital returns to businesses.

Building the Future, Creating Abundance Together

Technological innovation and application are also crucial cornerstones for building a collaborative ecosystem for impact investing. Comprehensive collaboration—from technology, products, and solutions to capital—not only helps startups gain a foothold in fierce competition but also allows the public, businesses, and investors to jointly participate in the process of sustainable development. By smartly using technology and actively engaging in this win-win ecosystem, we can collectively forge an abundant future where social benefit and economic returns go hand in hand.